Shares of Tremendous Micro Laptop Inc SMCI closed 31.24% larger in commerce on Tuesday at $28.27 apiece. This occurred after it introduced the appointment of BDO USA as its Unbiased Auditor and in addition filed a compliance plan with Nasdaq, based on its press launch.

The aforementioned replace has prevented the corporate shares from being delisted from Nasdaq, nonetheless, firm insiders loaded up on the shares of SMCI earlier than this replace. Moreover, regardless of the rise in shares, analysts monitoring the corporate have principally downgraded the inventory.

What Occurred: Tremendous Micro Laptop shares have waded by way of a flurry in 2024 because it has been riddled with a number of troubles. It missed submitting the Kind 10-Ok with the SEC, the annual monetary report for the corporate’s 12 months ending June 30.

It was adopted by the discharge of the short-seller Hindenburg’s report on Aug. 27 stating that the corporate was concerned in accounting manipulation together with the allegations of self-dealing and evading sanctions.

Ernst & Younger resigned because the auditor of the corporate on Oct. 30 and it delayed submitting the Kind 10-Q with the SEC for the primary quarter of fiscal 2025, ending Sept. 30.

Additionally learn: Why Tremendous Micro’s Future Might Hinge On Nvidia Earnings, Nasdaq Deadline

Why It Issues: The inventory was practically 64% up at $28.27 per share from its 52-week low of $17.25 apiece. However nonetheless down 77% from its 52-week excessive at $122.90 apiece. On a year-to-date foundation, the inventory was down by practically 1%.

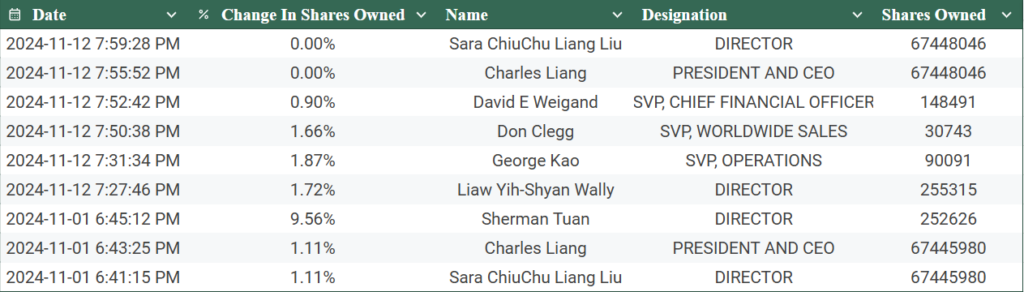

The relative power index at 45.26 implies that the inventory shouldn’t be overbought or oversold. The current commerce by firm insiders, as per Benzinga Professional exhibits that they purchased the shares earlier than asserting the appointment of the brand new Unbiased Auditor between Nov. 1 to Nov. 12.

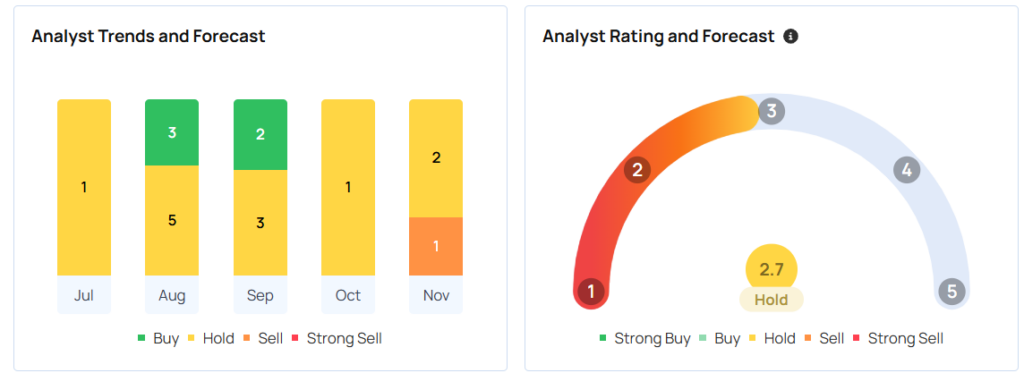

Analyst Snapshot

Many brokerages have lowered their rankings and goal costs on SMCI. In accordance with MarketBeat, Financial institution of America downgraded it to a ‘impartial’ ranking and decreased their goal value to $70.00 per share and Rosenblatt Securities reissued a ‘purchase’ ranking and set a $130.00 goal value, in August.

Barclays lowered their value to $42.00 apiece and set an ‘equal weight’ ranking in October. JPMorgan Chase & Co. lowered a “impartial” ranking to an “underweight” and set a value goal of $23.00 per share in November.

In accordance with Benzinga Professional, primarily based on a mean value goal of $27.67 between Goldman Sachs, JP Morgan, and Wedbush, there’s an implied -2.65% draw back for Tremendous Micro Laptop Inc. from these most up-to-date analyst rankings. The consensus ranking forecast on Benzinga, suggests a rating of two.7 out of 5 factors, which suggests holding the inventory.

Picture through Shutterstock

Market Information and Knowledge dropped at you by Benzinga APIs

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.