EveryDollar

Product Identify: EveryDollar

Product Description: EveryDollar is a zero-based budgeting app constructed by Dave Ramsey and follows the Ramsey principals of economic administration.

Abstract

EveryDollar is Dave Ramsey’s budgeting app. It has a free model that you should utilize so long as you want, however finally, you’ll doubtless need to enroll in the premium model so you may mechanically obtain transactions out of your financial institution accounts.

Execs

- Free model out there

- Integrates properly into the Dave Ramsey Child Steps (with paid plan)

- Straightforward to arrange and get began

Cons

- Should pay to hyperlink financial institution accounts and obtain transactions

- Unspent quantities don’t roll over to the subsequent month.

EveryDollar is without doubt one of the most well-known budgeting apps because it was constructed by monetary guru Dave Ramsey. It depends on his cash rules, often called the Child Steps, and the debt snowball compensation method.

Dave Ramsey generally is a polarizing determine however so many have used his method to get out of debt. I’ve talked to individuals who used his books to get their monetary life so as.

The outcomes communicate for themselves. You don’t should agree along with his private and political opinions if you wish to use his private finance method.

At a Look

- The free model means that you can create a price range and manually add spending transactions.

- To attach your financial institution accounts and mechanically import transactions, you’ll have to improve to the paid model.

- The premium model affords objective setting, paycheck planning, a monetary roadmap, and entry to a monetary coach.

Who Ought to Use EveryDollar?

EveryDollar is ideal for Dave Ramsey followers. If you have already got Ramsey+, which provides you entry to his course Monetary Peace College, EveryDollar is included in what you might be already paying for, making it a no brainer to at the least attempt it out.

The Premium+ plan additionally permits you entry to the monetary roadmap, which can present you precisely if you’ll accomplish every Child Step. This may be particularly motivating for these following the Dave Ramsey system.

EveryDollar Options

Desk of Contents

How Does It Work?

EveryDollar makes use of the budgeting system often called zero-based budgeting. In zero-based budgeting, you assigned each greenback to a class. It’s similar to envelope budgeting.

That is the place you enter your month-to-month earnings and plan your complete month’s spending forward of time. You arrange budgeting classes after which allocate your earnings to these classes.

Then, you utilize the app to trace your spending each day. When you’ve got the free app, you manually enter your transactions. For those who pay for EveryDollar Plus, you may hyperlink accounts, and it’ll mechanically pull in transaction information.

Setting Up EveryDollar

Signing up is straightforward. After you register, you’re requested to choose a number of cash targets:

Subsequent, you’re requested for some extra customized info:

The setup course of continues with you getting into your earnings, bills, giving, and debt figures.

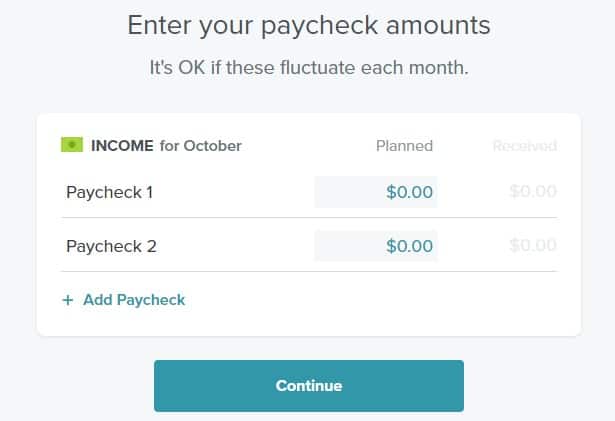

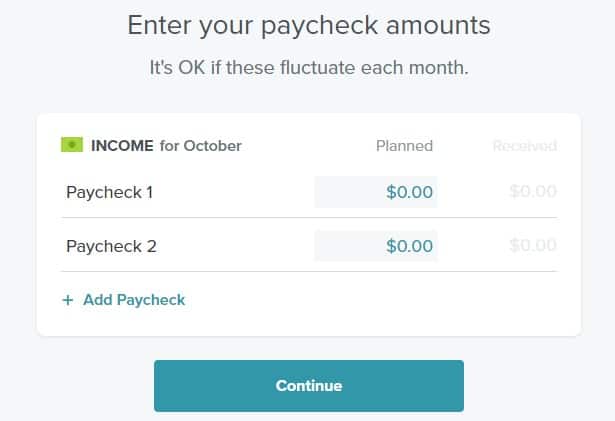

Right here’s what the earnings part appears to be like like:

In case you are paid each two weeks, you may set the earnings to be your complete in a month or set two (or three relying on the month) line objects for the 2 pay cycles.

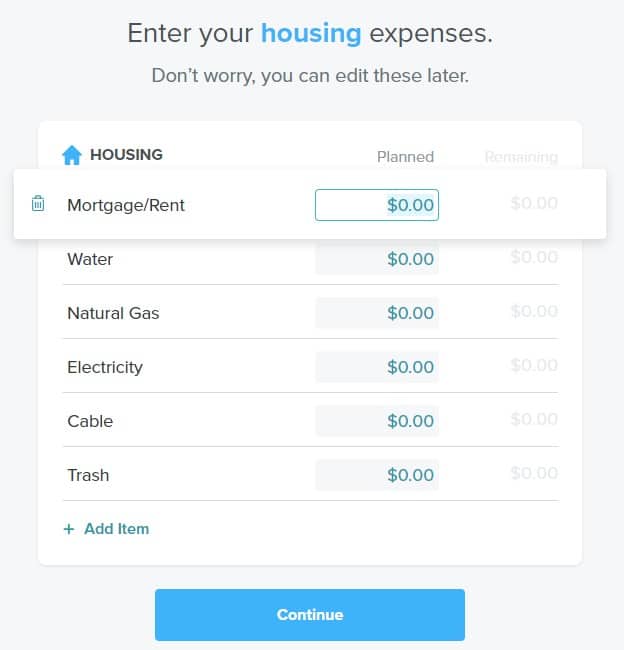

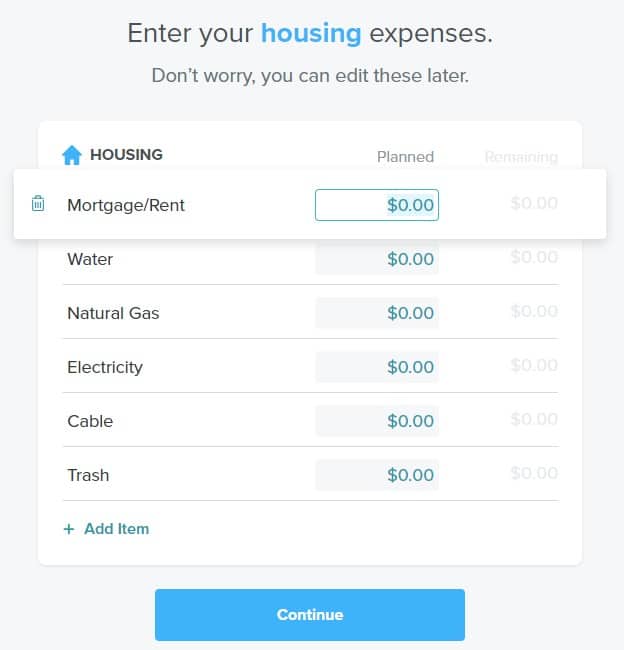

Then you definately’ll enter your fundamental bills (housing, utilities, meals, transportation and “private bills.”) It would stroll you thru every part, however don’t fear, they’re all simple to alter later.

You possibly can edit the names of the road objects and add new objects to every checklist. All through the method, you may overview how properly you allocate your earnings.

When you’ve added every of your price range line objects, you’ll see your price range.

There are a bunch of various sections, greater than I can seize in a single screenshot, and you’ll simply transfer them round to arrange your price range the way in which you need. You may also re-order the road objects inside every part.

Including Transactions

You might have been setting your deliberate spending quantities up till now. You don’t observe precise earnings and spending till you add transactions.

You possibly can add an earnings or expense transaction, the display screen above exhibits an expense at Chipotle for $24. You possibly can break up the transaction throughout many classes. Right here I’ve categorized it below Eating places, however you may see the place you may add one other class with “Add a Cut up.”

For those who click on on extra choices, you may add a Test # in addition to Notes.

For those who change the transaction kind to earnings, the choices don’t change. The one distinction is the button adjustments to “Monitor Earnings” as an alternative of “Monitor Expense.”

On the dashboard, you may see what you’ve budgeted and what you’ve left to spend:

EveryDollar Premium+

You possibly can price range at no cost with EveryDollar, however if you’d like to have the ability to join your financial institution accounts, you’ll have to improve to Premium. You’ll get 14 days free, after which it prices $17.99 per thirty days, or $79.99 per 12 months.

Together with importing your transactions, Premium+ means that you can set targets, entry paycheck planning, and get a monetary roadmap. You’ll even have entry to a monetary coach.

You may also improve to Ramsey Plus, which will get you a couple of extra objects, comparable to Monetary Peace College. Ramsey Plus prices $129.99 per 12 months after the 14-day free trial.

Paycheck Planning

Paycheck Planning is obtainable on Premium+ and means that you can schedule the dates of your earnings and payments. You possibly can set your paydays after which what days you want to pay particular payments. As soon as that’s set, you may set dates to fund different targets, comparable to your sinking funds.

With this characteristic, you can too activate SafeSpend, which lets you understand how a lot your paycheck is earmarked for particular classes, and the way a lot it’s a must to spend.

Monetary Roadmap

With the Monetary Roadmap characteristic, you may see your complete monetary image at a look. You possibly can see the place you stand along with your internet price, in addition to get future predictions based mostly in your present state of affairs. For those who observe Dave Ramsey’s child steps, you may see your progress and projected dates for when you’ll full every step.

You possibly can customise the plan and mess around with variables to see how small adjustments right now will influence the longer term.

EveryDollar Options

EveryDollar affords zero-based budgeting however not way more, so if you’d like a unique budgeting technique, EveryDollar isn’t the only option.

Additionally, EveryDollar doesn’t observe investments or have a group to hitch. For any of these, you’ll want another. Take a look at these options beneath or our checklist of the greatest budgeting apps for {couples}.

You Want a Finances

The closest various to EveryDollar is You Want a Finances, or YNAB. YNAB is a zero-based price range “give each greenback a job” system that prices $14.99 per thirty days, or $109 per 12 months, and comes with a 34-day trial.

In a YNAB vs. EveryDollar comparability, YNAB has a barely larger studying curve, however the device and help are manner higher. One among YNAB’s largest belongings is the group of people that use it. You will get a ton of help from the corporate and different folks such as you.

Right here’s our full YNAB overview for extra info.

Simplifi

Simplifi is a budgeting app that may be very simple to make use of. You possibly can plan and observe your spending, set targets, and handle your subscriptions. Your transactions may also obtain mechanically for simple categorization. You possibly can run reviews and get money move predictions, so that you’ll at all times know the place your cash went, and the place it’s going subsequent.

Simplifi prices $2.99 per thirty days for the primary 12 months and $5.99 per thirty days after that.

Right here’s our full overview of Simplifi to be taught extra.

Empower

Empower has computerized transaction downloads to a budgeting device that does fundamental expense monitoring and budgeting. Empower just isn’t on par with comparable budgeting instruments however they do funding monitoring, which isn’t out there in EveryDollar and others on this checklist.

As your funds evolve past budgeting, you’ll need an eye fixed in the direction of the longer term and your retirement. Empower affords these instruments at no cost and is an effective manner to assist guarantee your investments carry out the way in which you want them to.

Right here’s our full overview of Empower for extra info.

The Backside Line on EveryDollar

For those who’re a fan of Dave Ramsey and his method to cash administration, EveryDollar is an intuitive and easy-to-use device that will help you handle your cash. The interface can also be very clear and doesn’t seem to have commercials.

For those who’re simply on the lookout for a budgeting device, it’s arduous to justify paying $130 a 12 months for a budgeting device like this one. Once you lay within the academic part, it makes a little bit extra sense however I’d argue your cash is best off spent on requirements relatively than a price range. There are lots of nice budgeting instruments out there at no cost (or ad-supported) so you may hold the $130 to go in the direction of one thing else.

For those who’re within the Ramsey Execs or the monetary training, it is perhaps price it. That’s actually as much as you to determine.